(Bloomberg) – Subscribe to the New Economy Daily newsletter, follow us on economics, and subscribe to our podcast.

Global finance chiefs will meet in Washington in the coming days with a warning of a potential $4 trillion loss in global economic output ringing in their ears.

This is the Germany-sized hole in the growth outlook to 2026 that IMF chief Kristalina Georgieva identified last week as an imminent risk.

She will play host as central bank governors, finance ministers and others as they grapple with the repercussions of rampant inflation on the global economy, monetary tightening, rising debt, and Europe’s biggest ground war since World War II.

The annual meetings of the International Monetary Fund and the World Bank will be entirely in person for the first time since the outbreak of the Covid-19 virus in early 2020, showing progress in stamping out the epidemic, it will be uncomfortable given the other headaches.

The current confluence of economic, climate, and security crises makes it different from anything global policymakers have seen since 1945. However, some elements, such as the havoc in emerging markets wrought by the Federal Reserve’s interest rate hike in the early 1980s, chime with the present predicament.

“The big question for the meetings is, ‘What are we going to do in terms of the institutional response to this, beyond business as usual,'” Masoud Ahmed, president of the Center for Global Development in Washington, said last week.

Here’s a quick look at some of the issues officials will be dealing with:

-

World Economic Prospects: The International Monetary Fund releases this on Tuesday. Georgieva said last week that the global growth forecast for 2023 of 2.9% will be lowered.

-

Ukraine: The country that Vladimir Putin’s forces invaded in February will remain in focus, from the impact of a depleted grain harvest to the pressure of Russian gas on Europe. The International Monetary Fund’s board on Friday approved a $1.3 billion loan to Ukraine, the nation’s first since early March.

-

Food prices: The International Monetary Fund’s board last month approved a new emergency financing “food shock window” to help countries affected by rising agricultural costs.

-

UK: The country remains at risk after market turmoil forced a partial turn in the tax cut package from Prime Minister Liz Truss’s new government that has been criticized by the International Monetary Fund.

-

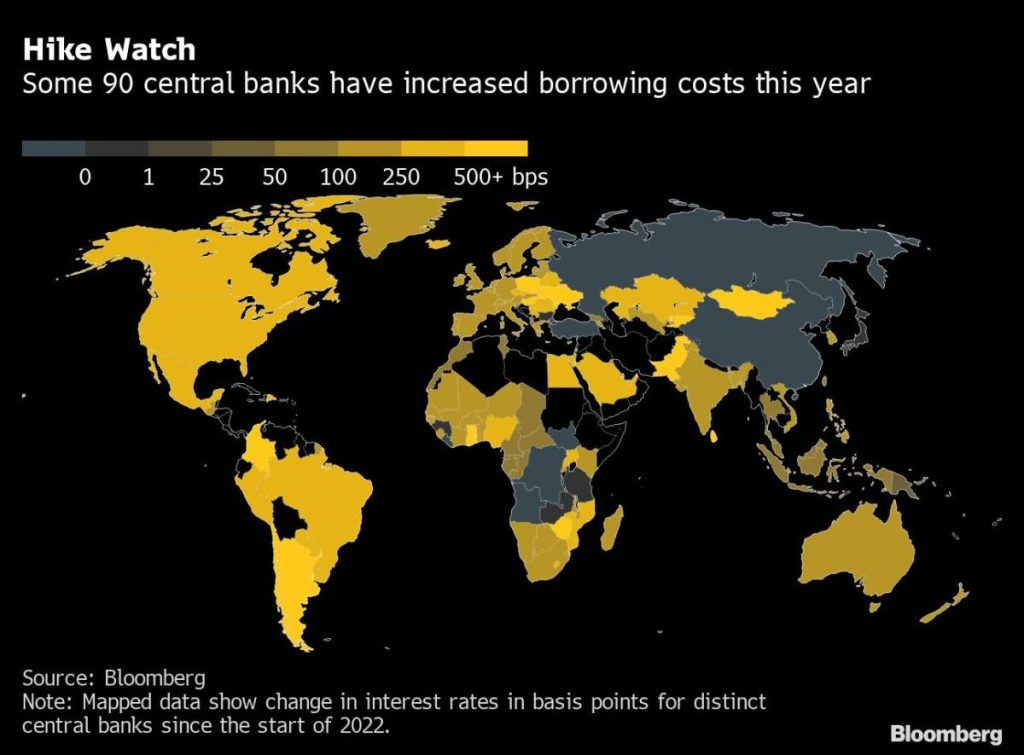

Federal Reserve: US tightening is hurting other economies. IMF calculations show that 60% of low-income countries and a quarter of emerging markets are in or near debt distress.

-

Climate: The crisis is getting worse, as evidenced recently by disasters from floods in Pakistan to hurricanes that hit Puerto Rico and Florida.

Elsewhere this week, a faster reading of core inflation in the US, financial stability news in the UK, an interest rate hike in South Korea and the Nobel Prize in economics will be among the highlights.

What Bloomberg Economics says:

“When foreign finance ministers and central bank governors gather in Washington for the World Bank and International Monetary Fund meetings next week, many may argue that the rest of the world cannot afford any additional Fed increases.”

Anna Wong, Andrew Hosby and Elisa Winger. For the full analysis, click here

Click here to find out what happened last week and below is our summary of what will happen elsewhere in the global economy.

US economy

In the US, the CPI is the highlight for the coming week. Thursday’s Labor Department report will give Fed officials a snapshot of how inflationary pressures are developing after a series of massive interest rate increases.

Economists estimate that the consumer price index rose 8.1% in September from a year ago, slowing from the 8.3% annual increase the previous month as energy prices stabilized. However, excluding fuel and food, the so-called core CPI is still accelerating – it is expected to show an annual gain of 6.5%, versus 6.3% in August.

An increase in that volume in the primary metric would match the biggest advance since 1982, illustrating stubborn inflation and keeping the pump ready for a straight 75 basis point rate hike at the November Federal Reserve meeting.

Investors will hear from a number of US central bankers next week, including Vice President Lyle Brainard and the Federal Reserve’s regional chairs Loretta Mester, Charles Evans and James Bullard. The minutes of the Federal Reserve’s September meeting will be released on Wednesday.

Other data includes figures on prices paid to US producers. So-called wholesale inflation showed signs of abating as commodity prices weakened amid concerns about a global economic slowdown.

The week will be capped with retail sales data. Economists expect modest monthly progress in September, helped by an increase in car purchases. Excluding autos, the value of retail sales is expected to decline for a second month. Since the numbers were not adjusted for inflation, the data indicates a slowdown in demand for goods in the third quarter.

Asia

Bank of Korea Governor Ri Chang-yong may take a short detour on the rate hike scale. While it returned to its usual quarter-point increase in August, many economists see it picking a move of twice that size on Wednesday as the fast Fed squeezed the won.

The Monetary Authority of Singapore is seen on the verge of tightening for the fifth consecutive meeting, while the State Bank of Pakistan is expected to keep the interest rate steady for a third.

Assistant Governor Lucy Ellis may shed light on the Reserve Bank of Australia’s latest policy thoughts after its pivot to small rallies.

Bank of Japan Governor Haruhiko Kuroda and Finance Minister Shunichi Suzuki will be in Washington for IMF meetings, as the yen’s moves remain under close scrutiny.

Meanwhile, China has been hit by a rebound in Covid-19 cases after the week-long National Day holiday, just as the country’s top leaders are gathering in Beijing for a meeting with President Xi Jinping.

Europe, Middle East and Africa

The week begins with the announcement of the Nobel Prize in Economics on Monday. The award was created by Sweden’s Riksbank in 1968, adding a sixth category to the existing prizes for physics, chemistry, medicine, peace and literature. Three academics based in the United States won in 2021 for their work using real-world experiments to revolutionize experimental research.

The Bank of England’s Monetary Policy Committee will take center stage on Wednesday, an emphatic sign that the UK is facing major problems.

The committee, which is responsible for emergency intervention to prevent a vortex in the bond market last month, will release a record for its last meeting. That may provide insight into whether officials see the risk of a renewed turmoil that has already plagued pension funds after Britain’s mini-budget. It may also address the effects of a sharp increase in mortgage rates.

Bank of England Governor Andrew Bailey is among several officials scheduled to speak next week, many of whom will be present at or near IMF meetings.

Likewise, several other officials from across Europe will speak in or near Washington. European Central Bank President Christine Lagarde and her Swiss National Bank counterpart Thomas Jordan are scheduled to deliver their comments.

In terms of European data, the UK will provide the most important news. The jobs and growth reports may paint a richer picture of how the UK economy is doing amid rising inflation and rising inflation.

Industrial production in the Eurozone on Wednesday is likely to partially rebound in August after a much larger decline in the previous month.

Inflation data will feature prominently in the rest of the region. In Hungary on Tuesday, the pace of price growth could reach close to 20%, while Sweden’s main gauge is expected to exceed 9% on Thursday. Israel and Egypt will also release inflation reports.

To the south, Ghana’s measure of price growth is expected to more than triple the central bank’s 10% target ceiling for the third consecutive month.

Latin america

The week begins with the closely watched weekly focus survey of the Central Bank of Brazil for market expectations. Analysts lowered their inflation forecast for 2022 for 14 consecutive weeks to 5.74%, while the GDP forecast for 2022 during that period was raised to 2.7%.

This increasingly optimistic view of consumer prices in Brazil is likely to be confirmed by data published on Tuesday: Analysts expect price gains to moderate for the third consecutive month in September, leaving the annual pace just above 7% – a full five percentage points lower. Peaked 12.13% in April.

With inflation in Chile near a three-decade high, the central bank is sure to extend a record tightening cycle, likely to push its key interest rate up 50 basis points to an all-time high of 11.25%. The next bank meets in December.

On Thursday, Mexico’s Bancico published the minutes of its September 29 meeting, in which policy makers raised the key interest rate to 9.25%. Many analysts see another 125 to 175 basis points of tightening before officials decide their work is done.

At the end of the week, Argentina is expected on Friday to report an inflation rate in September on an annual basis not far from the 83.45% recorded by Turkey, the highest rate in the G20. 100.3%.

Most Read From Bloomberg Businessweek

© Bloomberg LP 2022

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/YA3OKI4R25L6DHRDBV4BZHGRZY.jpg)

More Stories

The Bank of Japan keeps its monetary policy unchanged

Net neutrality was restored after the Federal Communications Commission (FCC) voted to regulate Internet service providers

FCC reinstates net neutrality in blow to ISPs