Federal funds target rate

Federal or state funding

target rate

Federal funds target rate

Federal or state funding

target rate

Federal or state funding

target rate

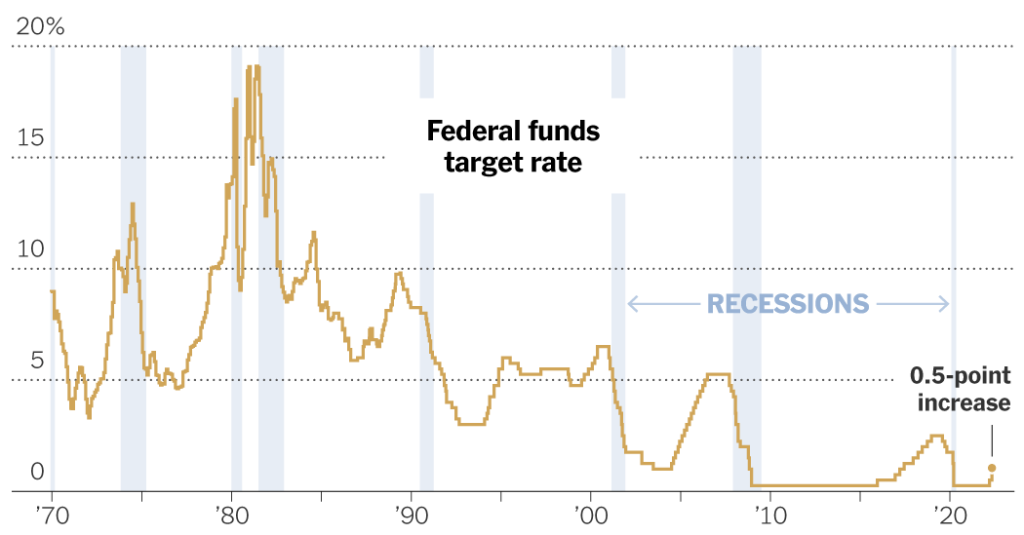

The Federal Reserve raised interest rates by half a percentage point and announced a plan to reduce its massive holdings of bonds, crucial measures aimed at curbing the fastest inflation in four decades.

Wednesday’s move marks the Fed’s biggest rate increase since 2000, and by simultaneously shrinking its nearly $9 trillion balance sheet, the Fed is rapidly withdrawing support from the economy. Policies are more likely to bounce back together through markets and the economy as it becomes more expensive to borrow money.

The rapid decline in monetary aid is a sign that the central bank is getting serious about calming the economy and the labor market as rapid inflation continues and officials are nervous about becoming more permanent. Prices soared in Fastest pace in 40 years For months now.

At a news conference following the decision on Wednesday, Federal Reserve Chairman Jerome H. Powell says “inflation is too high” and that the Fed “Move quickly to bring him back down.”

He indicated that policymakers could continue to raise rates in larger-than-normal increments as they did on Wednesday.

“There is a general feeling with the committee that an additional 50 basis point increase should be on the table in the next two meetings,” Powell said.

Policymakers spent most of 2021 hoping that inflation would ease on its own as supply shortages abated and as the economy stabilized after early pandemic disruptions. But normal life has not yet returned, and inflation is accelerating. Now, a new pandemic is linked Lockdowns in China and the war in ukraine It increases the prices of commodities, food and fuel. At the same time, there is a shortage of workers and Wages are rising Quickly in the United States, fed on Service price hike Where consumer demand remains strong.

“The shutdown in China is likely to exacerbate supply chain disruptions,” the invasion of Ukraine “and related events create additional upward pressure on inflation and are likely to impact economic activity,” Federal Open Market Committee statement Lamy said. “The committee is very concerned about inflation risks.”

The Fed reiterated that “inflation remains elevated, reflecting pandemic-related supply and demand imbalances, higher energy prices, and broader price pressures.”

Federal Reserve officials have decided they no longer have the luxury of waiting for inflation to moderate on its own, and are expected to keep raising rates at their meetings throughout the year, with many investors anticipating significant increases in June and July. Some officials have even suggested a 0.75 percentage point move might be possible, but Mr. Powell said such a large increase was “not something the committee is actively considering”.

And while the Fed acknowledged that inflation may remain fast as supply disruptions in China and the war in Ukraine exacerbate price pressures, some analysts doubted that this may require greater action.

“What they are trying to do is tell the market — inflation could be higher in the near term,” Gennady Goldberg, rate analyst at TD Securities, said of the Fed’s signals for Ukraine and China. “It doesn’t mean they should raise 75 basis points, because that’s not the kind of inflation the Fed can control.”

Determining how quickly to remove policy support is a risky exercise. Central bankers hope to act decisively enough to stop price hikes, without curbing growth so hard that they are pushing the economy into a painful recession. distance Engineering a so-called soft landing is likely to be a challenge.

The Fed plans to Shrink its balance sheet Starting in June, allow securities to mature without reinvesting. On Wednesday, it said it would eventually allow up to $60 billion in Treasury debt to expire each month, along with $35 billion in mortgage-backed debt. This plan will be fully phased in from September.

The Fed’s plan to reduce its holdings is likely to take power out of financial markets and could help cool the housing market as it raises long-term borrowing costs, reinforcing the effect of the central bank’s interest rate increases. Expected moves from the Federal Reserve are starting to push mortgage rates higher.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote