- Solana stocks have been on the rise over the past 24 hours as the daily chart has turned red.

- If there is a price rally, SOL may first target the $188 level.

After a week of rising prices, Solana [SOL] It has recently witnessed a slight correction in price. But the scenario may change soon as the token has successfully retested the bullish pattern.

This episode means that the token may soon start another bullish wave, which could push the token to new highs.

Solana’s bullish move

according to Coin Market CapSOL price has increased by more than 6% in the past seven days. However, the last 24 hours have been somewhat of a setback as the token’s value has decreased by 0.83%.

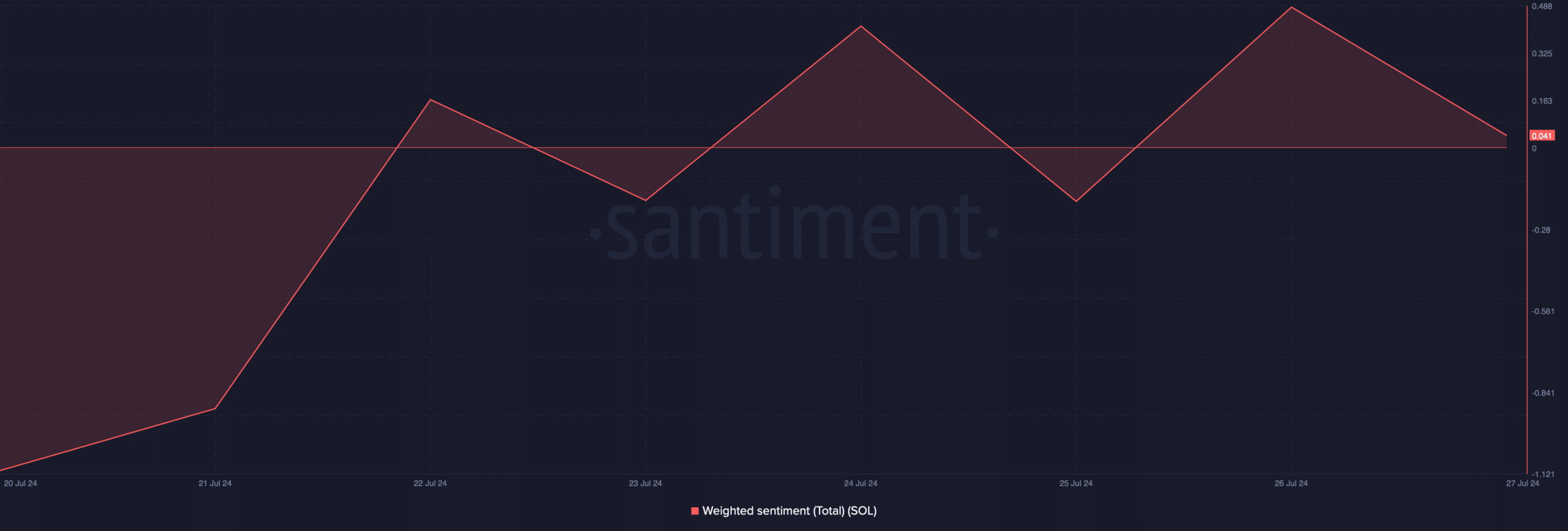

The recent price drop had a negative impact on its weighted sentiment on July 27, indicating that bearish sentiment around the token has increased.

Source: Santiment

However, this may not actually be the start of a bearish rally, as SOL recently broke out of a bullish pattern.

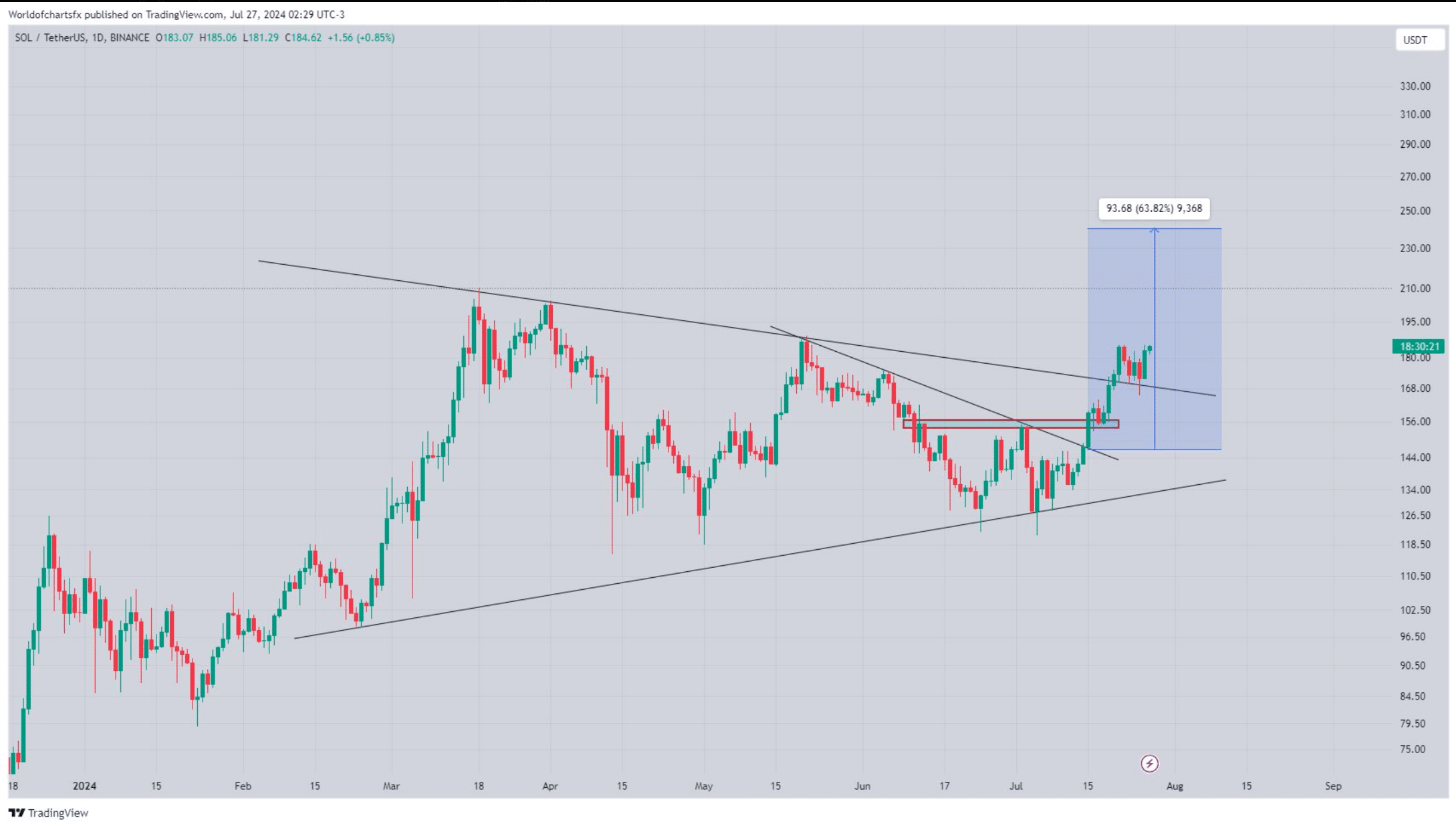

World Of Charts, a popular crypto analyst, recently published tweet Highlighting the fact that SOL broke through the bullish flag pattern and retested its support as well.

To clarify, a bullish pennant pattern appeared in March, and since then Solana price has been consolidating within the pattern, only to break it a few days ago.

The tweet also mentioned that a recent retest of support could start an uptrend that could push Solana to $250, a new all-time high.

Source:X

Is SOL likely to hit $250?

Since the $250 target seems a bit ambitious in the short term, AMBCrypto planned to dig deeper into the SOL case to see what to expect from it.

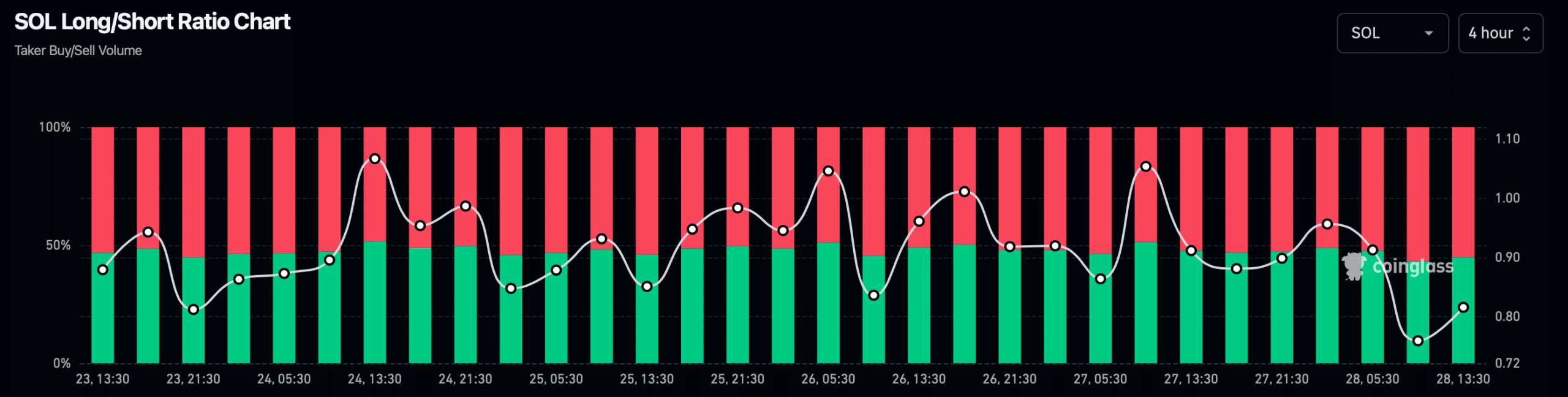

According to our analysis of Coinglass data, the buy/sell ratio of SOL increased after the decline. The decrease in the metrics means that there were more long positions in the market than short positions, which is considered a bullish sign.

Source: Coinglass

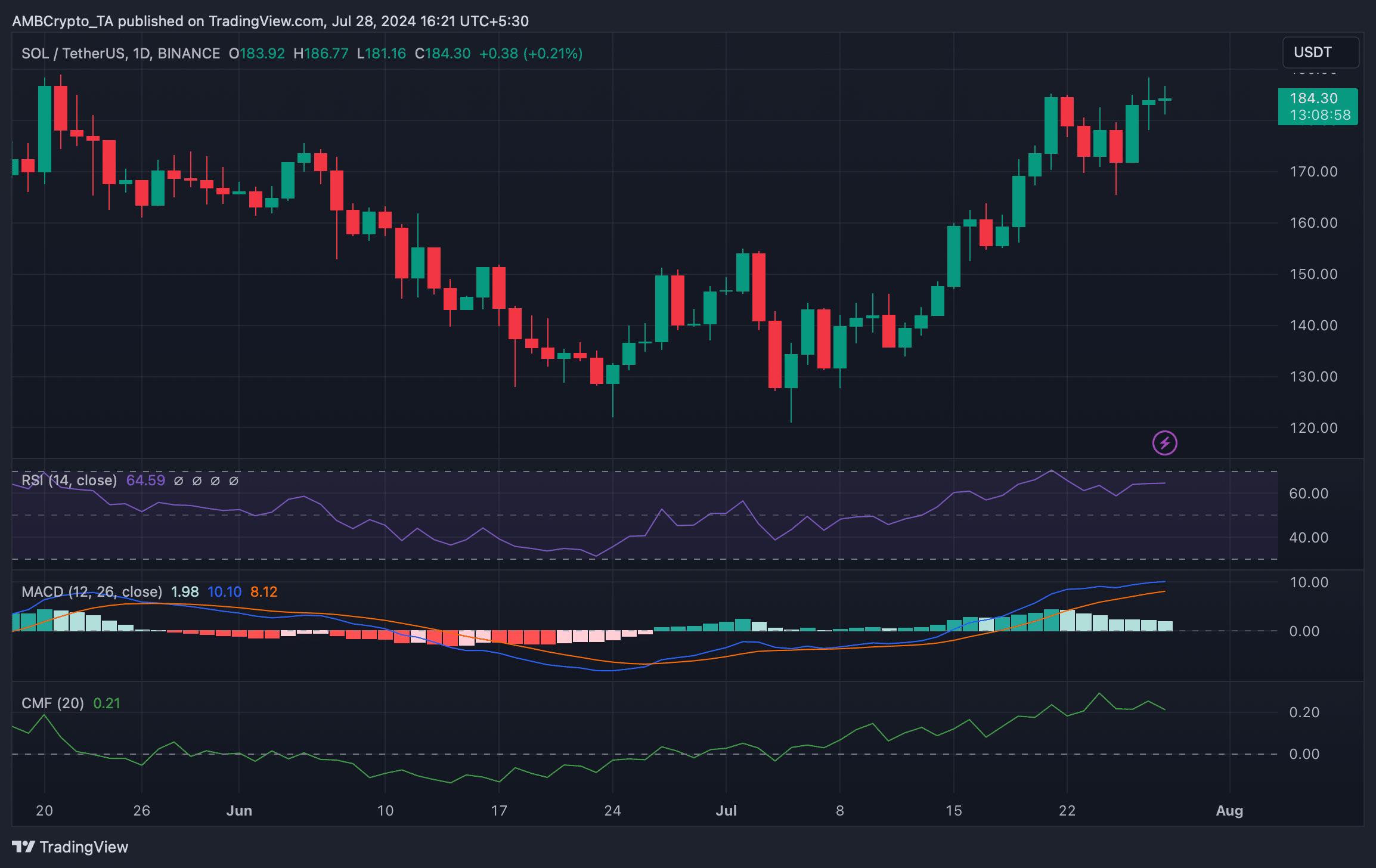

We then examined the daily chart of the symbol to see if it could indeed start an upward rally in the near term. According to our analysis, SOL’s Chaikin Money Flow (CMF) indicator registered a decline, as did the Relative Strength Index (RSI).

Both technical indicators indicated that prices will continue to decline. Moreover, the MACD indicator also showed the possibility of a bearish crossover.

Source: TradingView

Realistic or not, here you go. SOL Market Cap in BTC conditions

In case of a bullish takeover of the market, Solana could touch the $188 level again before setting its eyes on the $250 level.

However, if the bears continue to dominate, as market indicators suggest, investors could see SOL drop to $176.

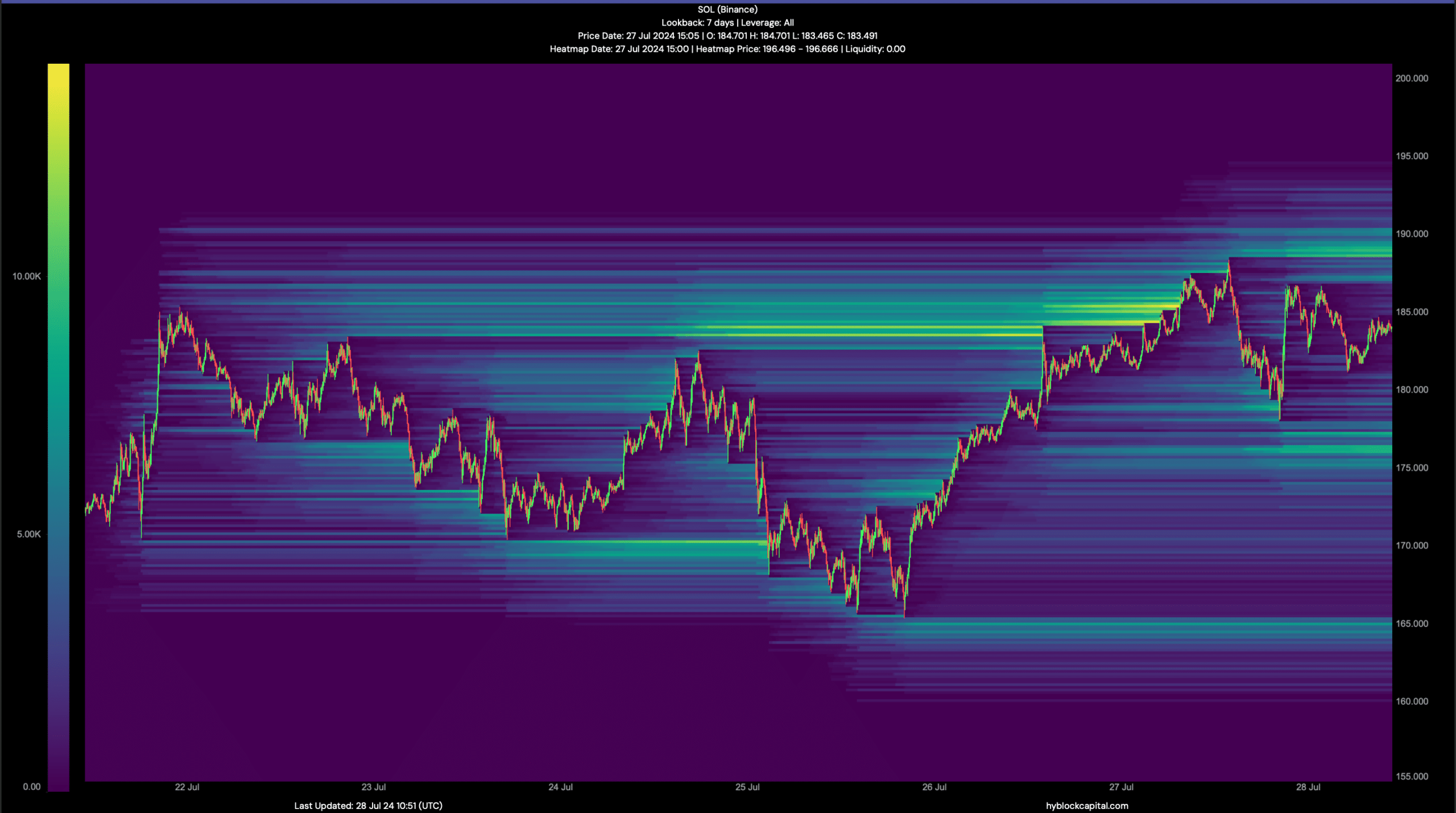

Source: Hyblock Capital

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote