:quality(85)//cloudfront-us-east-1.images.arcpublishing.com/infobae/6AMCWZJ3FNCH3O4HHV2NCFRAUY.jpg)

The Ministry of Economy will hold from this Tuesday Transfer of credit in pesos for the year and will seek to destroy it Half of maturities In the first quarter of the year by issuing a set of long government bonds that link to a fixed rate, against movements in the exchange rate and against inflation.

Debt in pesos: The government will carry out more transfers throughout 2023 to reduce maturities

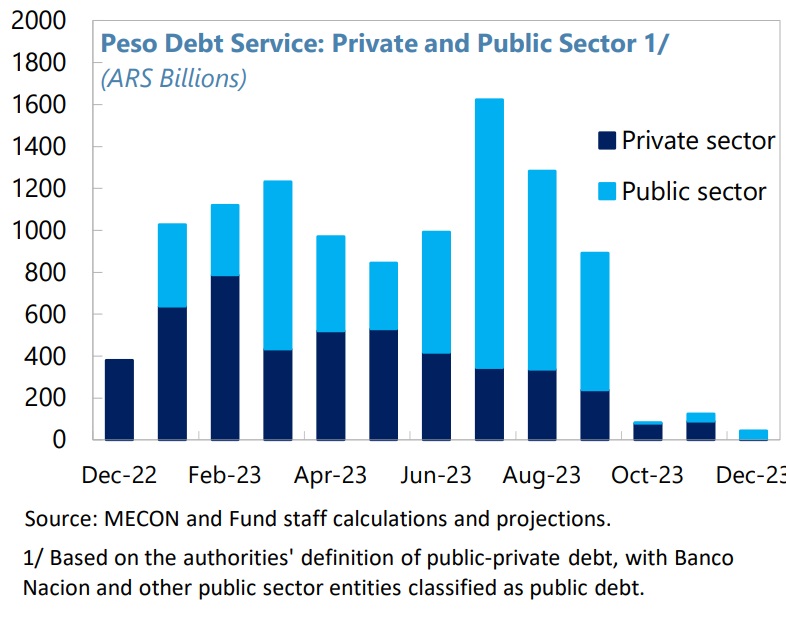

The economy is preparing further transformation measures to resolve payment obligations in the hands of 60% public sector by 2024. The first offer will be made in the first two months of the year

The finance ministry will launch its first alternative move, which will cover the payment obligations provided in the fiscal road map, between January and March. $4.2 trillion. Of that total, it is estimated to be in between 50% and 60% They are in the hands of the public sector, which includes official banks, the ANSES Stability Guarantee Fund and the Central Bank. Since this is Monday, the exchange will take place with normal operations on the first day of the market holiday In America.

The transaction includes LECER X20E3 and X17F3, LEDES S31E3, S28F3 and S31M3, BOTE TB23 and BONCER, TC23 and TX23 for a basket of LEES or double bonds, reaching maturities. February 2024. Beyond that particular bond, TDF24, the rest of the Treasury’s issues mature before September next year, before the presidential election.

Debt in pesos: The government ended the year with a tender for $326,000 million, more funding than needed.

In the last tender of the year, the portfolio led by Sergio Massa reached a refinancing rate of 521% and the offers reached a nominal value of $606 billion, almost 10 times the expected maturities; What fees were paid and how much was collected during the month

Even if the terms are in line with the demand of the private sector, the treasury will refuse to finance it Six months, the reality is that public bodies, especially central banks, cannot participate in primary loan tenders. Overall, the public sector has more than 60% of its debt denominated in pesos, having actively participated in recent financing activities this month.

This Monday, in a supplemental announcement to last week’s original call for bids, Finance added one more Third basket Bonds that investors should choose from include a CER bond from June. This option is available to owners of Lecer X20E3 and X17F3 which expires on January 20 and February 17.

After a bitter 2022 for dollar bonds, what do investors expect in the coming year?

Ultimately, sovereign debt in currencies ended up with a loss of the order of 20%. The rebound in the second half makes it one of the hot races for local investors

According to official and market sources, this topic is mainly intended Banks They can hold public bonds for a slightly longer period than mutual funds. With this last addition, they commit to the economic group that they will seek to give their participation Private sector In the first exchange of the year.

During the first semester of this year, the maturity profile was defined $8.2 trillion, adding another $2 billion in July. After the last tender of the year, the March-April two-month period will be the most critical, as $3.7 trillion is due.

According to an estimate by consulting firm Aurum Valores, maturities of pesos that the Treasury faces with the private sector in the first quarter of 2023 are almost $2.7 trillion: about $924,000 million matured in January, another $834,000 million in February, and about $933,000 in February and March. Millions.

If we add the maturities of the titles held by the public sector itself, the liabilities will rise $4.2 trillionThe transfer will be effective as per the official calculations.

But refinancing will not be the only challenge, as the IMF has projected that the government will have to expand it. Financial margin In the market to meet the financial needs of 2023, always within the framework of compliance with financial and cash targets. According to the agency’s estimates, this should occur at a level equivalent to 3% of GDP.

The strategy to continue with exchanges throughout 2023 was also revealed in the last technical report published by the fund. In a section where Argentine authorities analyze the situation and their plan of action for the coming months, the economic group said, “In the context of challenging internal and external conditions, efforts to raise net internal financing continue. A proactive market-oriented approach to debt management has helped net market financing of approx. 0.9% of GDP From the end of July.

“New instruments are being considered to raise funds in pesos until the end of this year, including the participation of companies and sub-national governments in pesos. Beyond 2022, the financing strategy focuses on Reduces risks Exchange rate and maturity and address revisions expiring in 2023,” the IMF Pre-Economic Committee explained.

In that regard, the Ministry of Economy listed: “The options under consideration are: Securities exchange Next year arrears for bonds outstanding in 2024, including those in other PSUs; Stimulates demand from banks to government bonds; Developing tools and methods to help manage Market volatility”.

Continue reading:

“Introvert. Thinker. Problem solver. Evil beer specialist. Prone to fits of apathy. Social media expert. Award-winning food fanatic.”

More Stories

Two influencers drown after refusing to wear life jackets: “ruining selfies”

Uruguay 2024 election results: who won and when is the second round | Waiting to know whether there will be a runoff or not

Uruguay: Lacalle Pou leaves with his figure on the slopes | The Marcet and Asteziano scandals hit the right-wing ruler