- The price of XRP rose just 1% in the past week.

- Key technical indicators point to a further decline in the value of the altcoin.

Ripple's native token XRP has failed to register any significant price rise, despite the overall market rally in the past week.

During that period, Bitcoin [ BTC] Price growth above the $70,000 price mark has led to an overall rally in the cryptocurrency market.

according to Queen Gekko According to the data, the global market capitalization of cryptocurrencies has increased by 8% in the past seven days. At the time of writing, this was $2.8 trillion.

XRP trends in the opposite direction

As of this writing, XRP is trading at $0.62. for every CoinMarketCapIts value has seen an increase of only 1% in the past seven days.

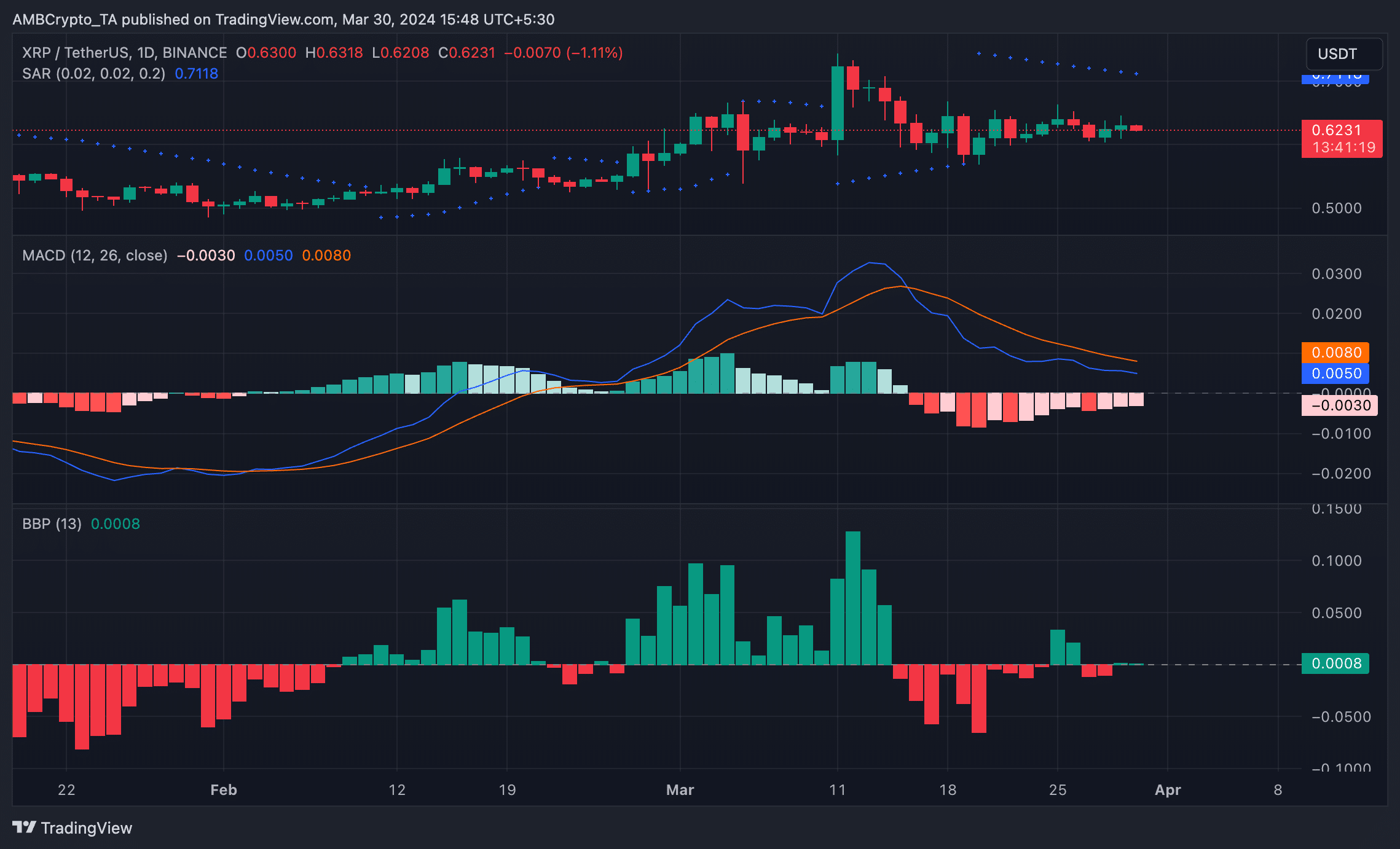

AMBCrypto readings of price movements on the one-day chart indicated the possibility of further decline in the value of the altcoin.

First, the price of XRP is below the Parabolic SAR at the time of writing. Traders use this indicator to identify potential reversal points in the direction of an asset's price. It is made up of points located above or below the price of the asset on the chart.

When the points settle below the price, it indicates an uptrend. Conversely, when it is placed above the price, as is the case here, the market trend is bearish. This also indicates that the decline in prices is likely to continue.

XRP's MACD line is spotted below the signal line, confirming the current downtrend. At the beginning of the bearish cycle, the MACD line crossed with the signal line on March 16, and the value of XRP has since fallen by approximately 10%.

This crossover is considered bearish because it indicates that the short-term momentum of the asset price is weakening compared to the long-term momentum. Traders often take it as a sign to exit long positions and take short positions.

Furthermore, XRP's Elder-Ray Index, which estimates the relationship between the power of buyers and sellers in the market, has been significantly negative in the past two weeks.

What is the value of 1,10,100 XRPs today?

This indicates that selling activity has exceeded accumulation among market participants.

Regarding the performance of XRP in the derivatives market, futures open interest has decreased slightly by 0.3% since March 13. This indicates that a large number of contracts have been closed as traders exit the market to prevent losses.

Source: XRP/USDT on TradingView

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Elon Musk Denies Reports He’s Directing $45 Million to Trump PAC

This extra-long yellow Cadillac electric sedan has a fridge in the back seat.

CrowdStrike shares fall as IT disruption continues