The battle for artificial intelligence supremacy has intensified with technology giant Google (Nasdaq:Google) unveiled the most advanced large language model (LLM) for AI, Gemini. GOOGL shares rose in trading Thursday following the news.

The company has included the new version of Gemini in its Bard chatbot. It also expects to launch its more advanced version early next year. The three versions of Gemini include Ultra, Pro, and Nano. The company is currently testing its Gemini Ultra model and will make it “available to select customers, developers, partners, and safety and liability experts for early trial and feedback before rolling it out to developers and enterprise customers early next year.”

Gemini Pro is currently being used at Bard for more advanced understanding and planning tasks. Google also intends to launch the Gemini Nano model on Pixel smartphones. Gemini Nano is a smaller version of the model, which can be used on smartphones and laptops.

Sundar Pichai, CEO of Google and Alphabet, commented: “I believe the transformation we are seeing now with artificial intelligence will be the most profound in our lifetime, and much greater than the shift to mobile or to the web before it.”

Wall Street is still bullish on Gemini

Following the news, JPMorgan’s top-rated analyst, Doug Anmuth, agreed with the different sizes of the Gemini model. Gemini’s diverse sizes cater to different use cases and devices, meeting industry demand for cost-effective models, the analyst added.

Anmuth noted that while there might be reservations about the Ultra 2024 release and the limited use cases of the Pro and Nano models, he was optimistic about the Gemini Pro running Google’s AI-powered Bard chatbot.

“Although it is still early days, the launch of Gemini represents an important innovation for Google as we enter the second year of widespread, commercial availability of generative AI,” the analyst commented.

Anmuth reiterated his buy rating with a price target of $150 on the stock, implying an upside of 9.7% at current levels.

What is the future price of GOOGL?

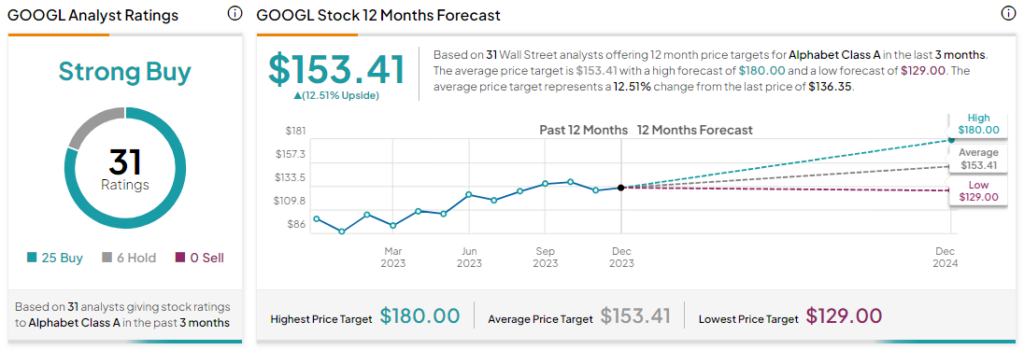

Analysts remain bullish on GOOGL stock with a Strong Buy consensus rating based on 25 Buys and six Holds. Even with GOOGL stock up more than 50% year to date, GOOGL’s average price target of $153.41 suggests 12.5% upside potential at current levels.

“Certified food guru. Internet maven. Bacon junkie. Tv enthusiast. Avid writer. Gamer. Beeraholic.”

More Stories

Google hints at ‘amazing things’ coming in Android 17 as AI takes center stage

Nintendo is launching a music app with themes from Mario and Zelda, and more importantly, a Wii Shop channel

The Google Pixel Tablet 3 will take another step towards replacing your laptop