Our own history and the history of other countries (Greece, Portugal, Ecuador, etc.) teach this. The International Monetary Fund is causing great disruption to economic and political stability. In the current Argentine case, the amount of debt is also proportional to the ability to pay.

To make the panorama even more dramatic, Free reserves at the central bank are very limited And even if the prospects are better than the current grim picture, it would be risky to assess an extraordinary short-term increase in dollars coming from drought-free Vaca Muerta, mining (lithium and others) and agriculture.

To take into account the unfair dimension of the debt with the IMF, it is worth referring to the following numerical exercise of available reserves and the amount of debt: if desired Cancel the debt, as Néstor Kirchner’s government did in 2005 (9.5 billion dollars with about 18 billion reserves), The Central Bank today needs to have about 90,000 million dollars to meet the total bill with funds and not be left in a vulnerable funding and exchange situation.

Hence this account is non-payable. It is not possible to display the nearest view that offers the possibility to complete the cancellation. Then A The main confusion is about what to do with the debt with the International Monetary Fund. This indicates what type of connection will be maintained with the major private lender without the economy collapsing. The multilateral system was set up as the financial arm of US geopolitics.

Three major cycles of external debt

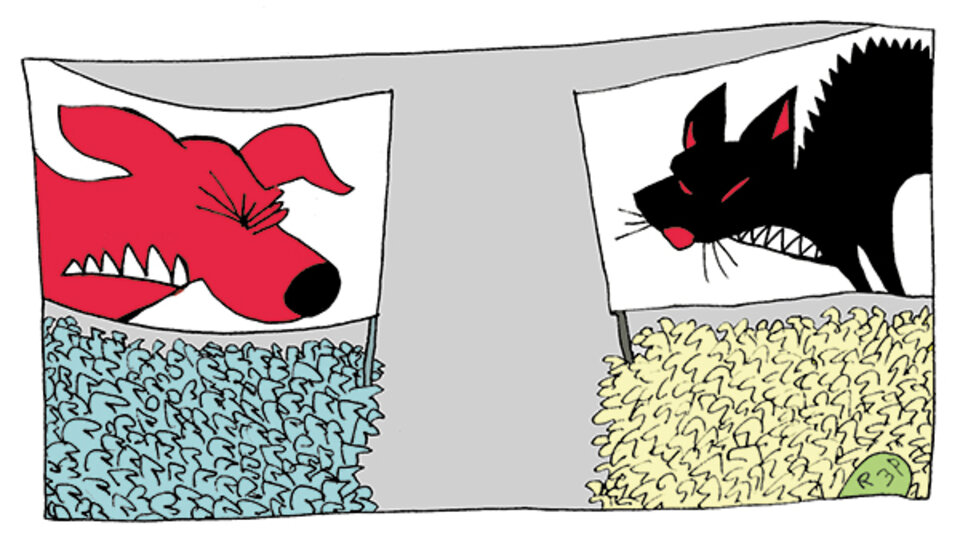

There are three paragraphs of the letter that CFK devotes to describing the origins of the current economic crisis, which marks the beginning of 2016. Mauricio Macri initiated the third largest cycle of external debt in Argentine history.

The first, started by Bernardino Rivadavia in 1824, with a Baring Brothers loan, was finally canceled 120 years later (in 1947). The second was born in 1976 with a military dictatorship that multiplied the debt tenfold and spread until it became unmanageable with an outburst of amortization and immediate default in 2001/2002. Macri began the third, which is still developing, with the dire situation that a significant portion of the debt is owed to the IMF.

There are similar features in the course of these three major cycles of external debt:

- Payment of interest surcharge.

- Transparent financial activities with no obvious connections between bankers and officials.

- Definition of the conditionalities of economic policy by creditor banks, firstly the International Monetary Fund, and later, the body that also acts as auditor of the creditor country.

- Diversion of received dollars towards other unexpected purposes at the time of seeking external loan.

- Improper use of acquired resources.

- Funds received from external credits were a feed channel for financial speculation in the local market followed by capital flight.

The origin of the investigation into the irregularities of the IMF loan

The loan with the IMF conforms to each of these features, which are repeated throughout the extensive journey of the country’s external debt. But there is one addition that makes it even worse. was A political loan to fund the election campaign of a right-wing candidate, fueled by America’s geopolitical ambitions: Prevent the victory of a “populist” political force and halt China’s advance in the region.

The balance is even more dramatic because of the failure of this US move: Macri lost the election and China continues to occupy Latin America, with the US joining the region (to help with infrastructure works and public finances). However, this extraordinary debt caused Argentina’s economy to a Greater financial and, therefore, political subservience to the IMF, as it says to the United States.

The last report of the nation’s public audit of this debt was the Labyrinth. It should be recalled that the original investigation into the IMF loan and the subsequent judicial complaint were carried out jointly by the Movement for National Recovered Institutions, the Center for Financial Coordination/CEPPAS and the Coordinator of Public Interest Lawyers (CAIP).

In May 2019, the investigation described in these pages led to the signing of the most important loan in Argentina’s history, and from the IMF. Macrismo violated each of the national regulations governing how administrative decisions of this nature should be made.. The AGN confirmed earlier allegations of wrongdoing by the Anti-Corruption Office, the Treasury Prosecutor and the nation’s Receiver General (Sigen).

while, Judge Maria Eugenia Capuchetti, with liability for legal action and apparent links to Macrismo, the file sleeps. This same magistrate ignores Vice President Cristina Fernandez de Kirchner’s request to deepen the investigation into the assassination attempt.

What is the effect of an economy with unpayable debt?

Throughout Argentina’s economic history External debt is an important factor in changing economic policy and economic structure, that is, the method of accumulation. It is established in the following learning.

- International financing served the needs of creditors and dominant economic sectors and then transferred capital abroad to earn extraordinary profits in dollars.

- Rather than contributing to productive growth, foreign debt helped to restructure private debt, shift multinational profits abroad, create oligopolies or monopolies, which displaced competition from firms without access to credit, and enabled the purchase of national assets by foreign firms. and accelerate the flow of capital.

- Economic adjustment imposes conditions to guarantee debt repayment, leading to a deep socio-labour degradation.

- The International Credit Institutions (IMF-World Bank) were born out of the Bretton Woods Agreement signed by Western powers after World War II to help countries with payment problems. That mission ended up fading and both institutions became auditors of debtor nations in the service of the global financial community.

- This scenario chart reveals that embargoes, payment suspensions, and defaults are responses to extreme situations into which indebted economies are thrown.

What Sergio Massa Says About Debt

In the meeting of the Reconstruction Front last Friday, the leader of this political group and the current Minister of Economy, M. Sergio MassaAmong other topics, he spoke about debt burden, According to Cristina Fernandez de Kirchner’s analysis.

He mentioned that the country lived Severe debt and it’s a legacy (Macri’s) that has haunted Argentina for years. Argentina’s economy had to face an epidemic like the rest of the world, but without credit (both internal and external ran out during the Macri administration), which means a very strong money problem “and that peso ball today partially explains the inflation. , due to the lack of multilateral debt and the lack of sovereign debt” .

I confirm that “Inflation Reflects Horror Drama” The summation of factors, beginning with “the debt that drove Argentina out of the fray in 2018” (when a deal was signed with the IMF to avoid default with private creditors) should be central. To conclude that the country is in the coming years Two major challenges:

- “One, the Vice President raised it very well yesterday, the debt issue. Argentina needs full political leadership to address the problems of debt and dollarization of the economyculturally but structurally”.

- “Another is the challenges of growth, but you have to That development should be brought to the people“.

Here’s what IMF’s Cristina Kirchner says in her latest letter

As mentioned, CFK sees the Macri government as the beginning of the loss of “economic democracy”. Because, recently he started “a brutal new cycle of foreign debt, which the International Monetary Fund will return as a way. Extraordinary, unprecedented and political debtIts purpose is not only to help that ‘friendly government’ win elections, but also to allow the withdrawal of speculative investment funds in dollars”.

In this instance, he points to what the IMF does in each country that receives financial assistance, which is not the same situation as when borrowing from international banks or large investment funds. The CFK fund “intervenes, takes the leadership of the Argentine economy, imposes its economic plan and the process of uncontrolled inflation in Argentina is rekindled”.

Thus, the operation of the fund not only disrupts economic stability, but is also political, as Christina Kirchner explains that “opportunity is not a political category, therefore, It is no coincidence that the two leaders who accepted the IMF’s plan did not retain electoral qualifications. However, there is causality in politics and the determining factor is economics.”

Those two presidents Mauricio Macri and Alberto Fernandez.

An economy with high dollar-denominated debt, dual currency, historic external controls and capital flight “inevitably puts our country’s current account in the red, which, given the dollar deficit, always ends. Uncontrolled inflation, currency running against the national currency, devaluation and hyperinflation“.

Here he provides an important definition of political and economic debate: “So it is impossible for any government Fairly managing the natural distributional struggle for income and making inflation the most powerful tool for transferring resources from society as a whole to the wealthiest and most concentrated sectors of the economy.

The word “impossible” conveys a confusing message to those who insist on a “cult,” implying that “any government” will have – in CFK’s words in a report on the Turo de Tomar-Cristina presidential program.

This judgment contains drama that requires improvement in the analysis of this hypothesis about the margin of activity of political and economic management.

For this, it is necessary to return to the dilemma exposed at the outset: What to do with the political relationship with the IMF (which is with the US) and how to approach debt management that cannot be paid now and has been for years. Under the current conditions of the Fund’s current macroeconomic plans.

I continued to read:

“Introvert. Thinker. Problem solver. Evil beer specialist. Prone to fits of apathy. Social media expert. Award-winning food fanatic.”

More Stories

Two influencers drown after refusing to wear life jackets: “ruining selfies”

Uruguay 2024 election results: who won and when is the second round | Waiting to know whether there will be a runoff or not

Uruguay: Lacalle Pou leaves with his figure on the slopes | The Marcet and Asteziano scandals hit the right-wing ruler